The 15+ Best Money Transfer Apps for Android and iOS

Are you looking for the best money transfer apps for your iOS and Android devices? Then, good for you, as we have covered the safest cash transfer apps in this blog. Read on to this blog to find out what they are!

Gone are the days when people used to stand in long lines at banks to send money to their loved ones or withdraw money from ATMs for their personal use. Now that it’s the 21st century, with more and more technological advancements, everything is possible at your fingertips, and sending money online instantly is no longer an exception.

Though there is a certain amount limit on online transactions via money transfer apps, it is still viable as the number varies differently for consumers and businesses. Also, with strict payment gateways, it is valid to say that your money is in safe hands.

Having said that, let’s get started on the best cash transfer apps (both national and international) for your iOS and Android device, including features and costs. And then you can decide which one you want to use.

Table of Contents

How to choose the right money transfer app?

We examined more than a dozen alternatives provided by the leading vendors in this industry to come up with our list of the top apps you can send money on, and we reduced it down include applications that fulfilled the following requirements:

Pricing: Each cash transfer app on our shortlist provides reduced (or free) basic checking account transfers and only levies extra costs when requesting quick money transfers or tying up with credit cards as a payment option.

Features: The applications include a range of benefits, such as fast transfer speeds (3-5 business days) and simplicity in connecting the app to your bank account.

Security: Two-factor identification and fraud detection are among the minimum two security elements we looked for in our selection of applications.

So, these are the points that one needs to consider, whether they are looking to transfer money for personal use or considering it as a must for their business apps.

Best money transfer apps for immediate and safest transactions

There are a lot of things to consider while choosing the best online money transfer apps, such as the user interface, transaction amount limit, security, and platform charges. Considering all these factors, we have listed our top picks for you.

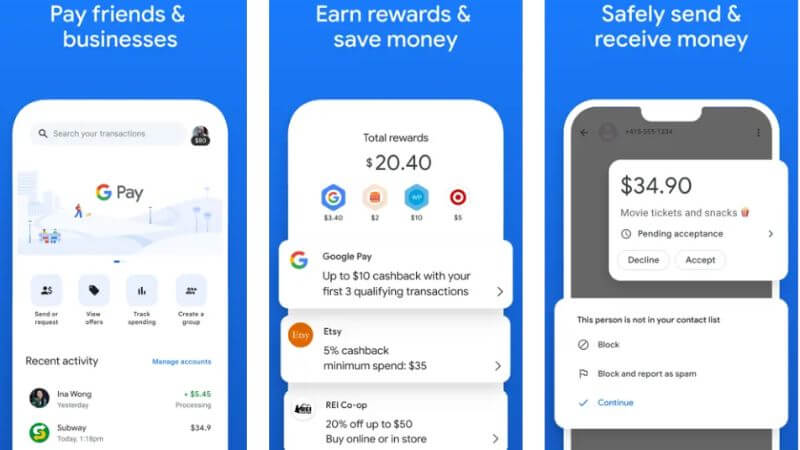

Google Pay

With an easy-to-use interface and a secure payment gateway, Google Pay is one of the best free money transfer apps through which you can do UPI transfers, mobile or DTH recharges, pay bills, book flights for your solo traveling trip, and, make B2B payments in a fraction of the time.

Moreover, earn amazing rewards (in the form of cashback or coupons) every time you make a payment via this app or refer it to your friends.

Features:

- Create a money send and receive group to keep tabs on expenses such as flat rent, trips, and more.

- Can do a transaction limit of 1 lac per day.

- Shop for brands or from websites directly linked within the app and get guaranteed rewards.

- Monitor all your everyday payments from all accounts within this single app.

- Highly secured with a pin, fingerprint, or pattern so that only you can make the payment.

- Make offline payments by bringing your device close to NFC terminals.

- No transaction charges.

Available on: Android and iOS

Pricing: Free to use.

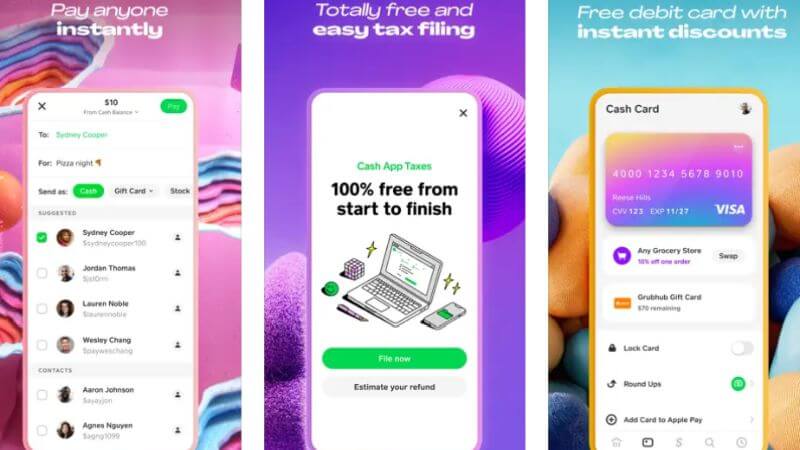

Cash App

Another of the most popular money transfer apps through which you can send, receive, and save money is the Cash App. The interesting thing about this app is that you can even invest your hard-earned money in stocks and Bitcoin and watch it grow right before your eyes. Interesting, no!

Features:

- Transfer money to your friends or family at zero fees.

- Free tax filing for state and federal returns No hidden fees; complete transparency.

- Order a custom Visa debit card directly from the app and use it to make instant transactions via swipe, dip, or tap. If you use an ATM, you may be charged a fee.

- Get instant discounts at your favorite stores, websites, or restaurants. No more waiting for redeeming points.

- Start investing in Bitcoin or stocks for as little as $1.

Available on: Android and iOS

Pricing: Free to use.

Don’t forget to check this – Common Mistakes Every Stock broker wants you to make

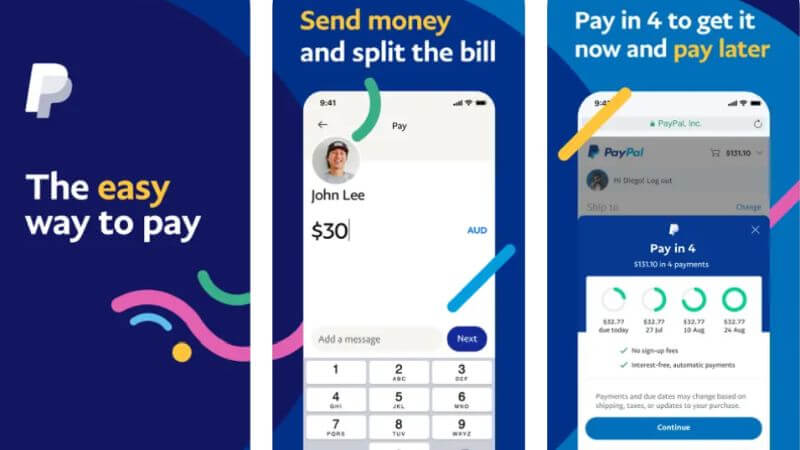

PayPal

PayPal, one of the original online money transfer applications, is a reputable financial business that is accessible worldwide. With an account, PayPal Cash, credit or debit cards, or another payment method, you can send money to your connections.

It is also the best app to send money internationally. So, whether you want to shop in India or around the world or transfer money for commercial purposes, everything is possible with this app.

Features:

- Buy now and pay later in four interest-free installments with no late fees.

- Buy and sell several cryptocurrencies, including Bitcoin, Bitcoin Cash, Litecoin, and Ethereum.

- Manage all your spending in one place.

- Support a cause by donating directly from the app.

- All your payments are secured with robust encryption and advanced fraud protection.

Available on: Android and iOS

Pricing: Free

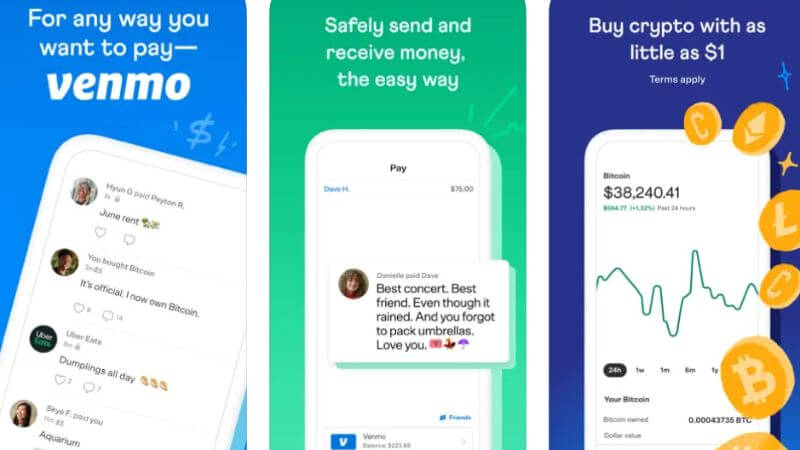

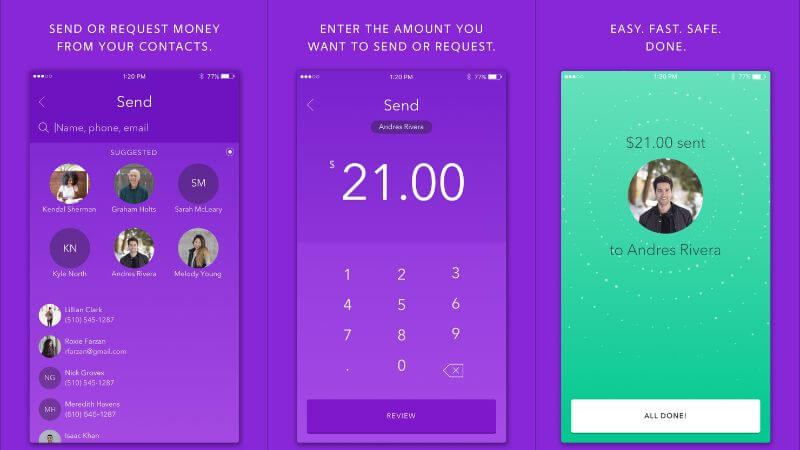

Venmo

Another one of the best cash-sending apps is Venmo which lets you pay and get paid with extra social elements. It is a PayPal subsidiary. Venmo, however, concentrates on between-user transactions, in contrast to PayPal, which is focused on corporate interactions.

It is a youth-oriented app created with the latest mobile app development techniques in consideration.

The Venmo app is proven to be a quick and simple way to transfer money with far more than 83 million users. The important thing to consider is that it only functions in the USA.

Features:

- Send and receive money with a personalized note in each payment.

- Split the basic utilities, and groceries, and settle up later. No hassle.

- Send a cash gift voucher for special occasions.

- Earn upto 3% cashback on every payment.

- Start to begin your crypto journey with as little as $1.

- Venmo is for everyone – for friends and business.

Available on: iOS and Android

Pricing: Free except 3% fees is levied on linked credit card payments.

Apple Pay

Next on the list of popular money transfer apps is e-Pay. All Apple devices including iPhone, iPad, watch, or Mac can use this secure digital payment software. It is a quick and secure way to make purchases online, via applications, or in shops. It may also be used to upgrade iCloud or other Apple services and enroll in Apple News, Itunes, or their other offerings.

You may make purchases with simply your touch ID; no account or form filling is required. The most alluring aspect of Apple Pay is the ability to send money instantly through texts without having to download an app.

Features:

- It’s a built-in app, so no more hassle to additional download and set up.

- Use Apple Cash with Apple Pay and send money directly via text or in your wallet.

- Accepted by more than 85% of retailers in the U.S.

- Works everywhere from subway stations to taxis to groceries to vending machines.

- Every transaction is protected with a unique transaction ID and device-specific number.

- Touchless transactions.

Available on: all Apple devices

Pricing: No additional fees for users/ merchants.

Zelle

The next top money transfer app, Zelle, has partnerships with several institutions and provides direct cash transactions from banks. Due to Zelle’s partnerships with banks, clients who have accounts there may send and receive money on the same day. Once more, this amazing payment app is US-based.

The only drawback is that you can’t use your credit card to make payments.

Features:

- No need to additionally download the app as it is in-built with other bank payment apps.

- All payments are secured with authentication and tracking features.

- Instant transactions in a couple of minutes (the only requirement is your account is linked to a U.S. bank).

Available on: iOS and Android

Pricing: Free

Remitly

Millions of people trust Remitly, another popular money transfer app when transferring money to loved ones who live abroad. You may transfer or receive cash to more than 100 countries, 3,000 banks, and 350,000 cash pickup locations globally with this app.

Receivers pay no additional expenses, while senders pay almost nonexistent fees. Also, you will be given the precise time and date your money will reach your recipient when you are transferring money.

Features:

- Send money via bank account, or debit/ credit card.

- Transfer funds to 50+ mobile money providers including GoPay, Vodafone, eSewa, and more.

- Conveniently send money directly to trusted banks or cash pick-up locations.

- Transactions are safeguarded with 2-factor authentication and robust encryption algorithms.

- Get special rewards on your first payment.

Available on: iOS and Android

Pricing: Free to download. Sending costs may vary based on the country.

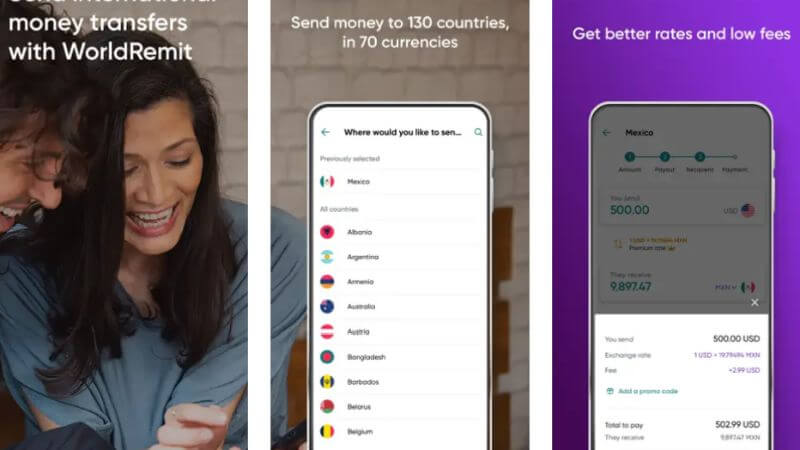

WorldRemit

Another best app for money transactions for international transactions is WorldRemit. It allows transfers online with no need for intermediaries to 150+ countries and 90 different currencies. The approval of the transactions happens quickly, in just a few minutes, and they are completely secure.

It provides a range of transaction options, including bank transfers, cash, wallet, online, and prepaid top-ups. It makes use of cutting-edge technologies to ensure the security of your transfer of funds. It charges a transfer cost, however, it is cheaper compared to other international exchange apps.

Features:

- Have Collaboration with international money providers including M-Pesa, Metrobank, MTN, and more.

- Money transferred can be conveniently received as a bank deposit, airtime pop-up, cash pickup, and more.

- Upfront low-cost fees.

- Approved by FCA and government authorities, so transfer money with no worries.

Available on: iOS and Android

Pricing: Free to download but levy an unpredictable fee on international transfers.

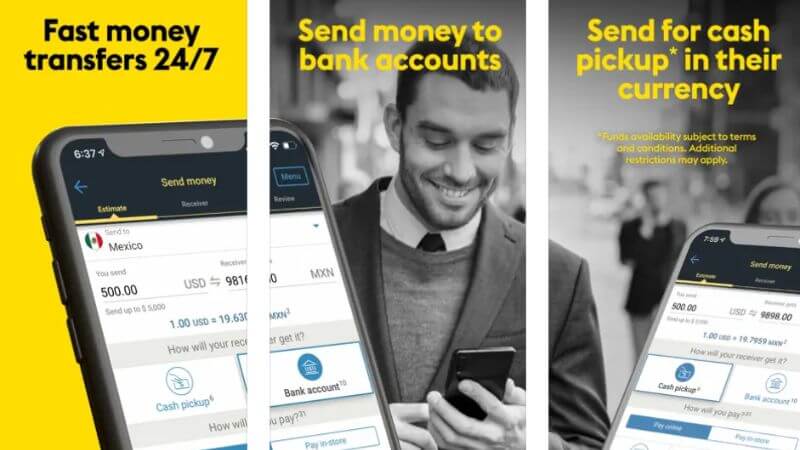

Western Union

Western Union is one of the best apps for international money transfers, with the ability to send money to more than 200 countries, including South America, Europe, and other territories, with the utmost convenience, a robust security system, and 24/7 customer support. And the best part is that for first-time users, there are zero charges on their first payment.

Features:

- Simply scan your debit/ credit cards with your phone camera and avoid space of entering the wrong information.

- View the current international exchange rates within the app.

- Save your recipient’s name to resend the list and quickly make repeat transactions.

- From paying insurance premiums to utility bills, make payments as you go.

- With PCI DSS compliant, all your payments are protected.

- Pay in multiple ways including via bank account, debit/ credit card, Apple Pay, and pick-up cash location.

Available on: iOS and Android

Pricing: Free to download

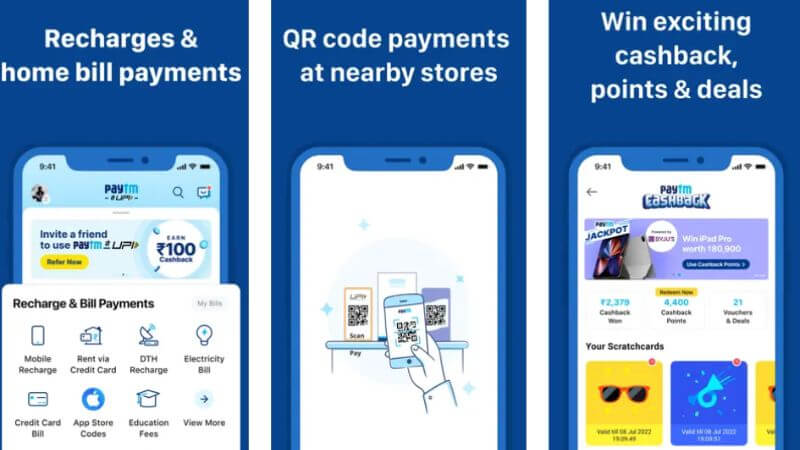

Paytm

Paytm is India’s most-loved and most secure money transfer app. It lets you transfer money from bank to bank, pay at grocery stores, eCommerce websites like Flipkart, and Amazon, or traveling websites like IRCTC, or for day-to-day utility bills including mobile recharge, fast tag, or DTH recharge, and a lot more. And not to forget the irresistible cashback reward points and coupon system on every single transaction.

Features:

- Send or receive money to any phone number or bank account via wallet, Paytm or BHIM UPI, or Paytm bank.

- Pay for metro recharge, subscriptions, or other services, and get the hottest rewards and offers.

- Never miss your SIP payments with the auto-pay and reminder options.

- Make payments to over 21 million stores including kiranas, supermarkets, petrol pumps, and more.

- Now invest in gold (buy, sell, or gift) at live market prices.

Available on: iOS and Android

Pricing: Free to download

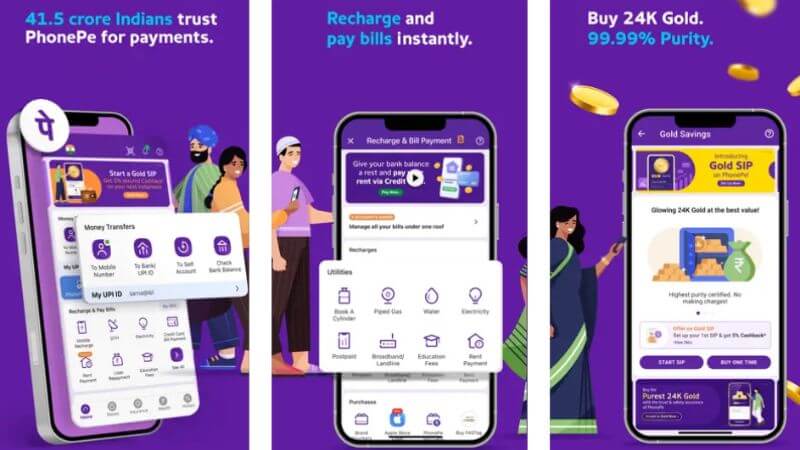

PhonePe

Users may easily make payments in India via PhonePe, a popular online payment software, and UPI-enabled project. The software allows for fast UPI money transfers, mobile and DTH recharges, and utility bill payments for things like gas, water, and electricity. Due to this, it is one of the most used money transfer apps in India.

Also, you may purchase insurance (auto, medical, bicycle, vacation, life, accident) at any location, pay your broadband bill, invest in mutual funds that reduce your tax liability, or buy gold.

Features:

- Secure your life, vehicle, and health with the in-app collaborated insurance companies.

- Invest in systematic plans, mutual funds, and gold, and let your money grow and achieve your financial goals.

- Pay however you like with app UPI, wallet, bank account, or debit/ credit card.

- Use your food, travel, and groceries app within PhonePe Switch without the need of downloading them.

- Gift your loved ones e-cards on special occasions.

Available on: iOS and Android

Pricing: Free to download. Only a platform-specific charge is levied.

Payoneer

Payoneer began as a universal free payment system to enable Indian businesses to do international transactions. It is the best international money transfer app, serving over 4.1 million clients, and is accessible in more than 200 nations. Considering this app as one of the most profitable business concepts.

Digital marketers, e-commerce vendors, and freelancers may all use Payoneer as a reliable payment option. It has aided several businesses in international commercial expansion. It has handled more than 21 billion international payments so far and offers countless commercial prospects.

Features:

- Get paid for having local bank accounts in EUR, USD, and more.

- Expand into new marketplaces and connect with them to get paid in a fraction of the time.

- With billing service, let international clients make you pay the most simply.

- Pay the VAT charges in the EU and UK with zero fees.

- Get a digital Foreign Inward Remittance Certificate direct to your account for free.

- Grow your business globally with the help of global partners.

- Track your incoming and outgoing payments from a single dashboard in multiple currencies.

Available on: iOS and Android

Pricing: Free to download.

MobiKwik

With MobiKwik, the supreme transactions app that enables you to easily handle all of your financial requirements, you can discover an entire universe of financial comfort. It is one of the mobile transfer applications that is expanding the fastest, with a network of more than 3 million businesses and 106 million users.

The Mobikwik app allows users to make funds transfer, recharges, payment services, and local purchases. It also provides the option to provide loans using a mobile wallet, which has several advantages such as requiring no collateral and having a straightforward approach.

Features:

- Link any account through BHIM UPI and have the best seamless transaction experience.

- Get instant credit upto 60,000 at zero cost.

- Boost your money with return series of up to 12%* p.a. And save the money for your business growth.

- Get exciting rewards and cashback every time you pay.

- Do all the mobile, DTH recharge, and order food, groceries, or medicines all from a single app.

- Pay for 300+ utility bills.

- Shop upto 2 lac on non-cost EMI. Also, there is a standard processing fee of 2-4%.

Available on: iOS and Android

Pricing: Free to download.

MoneyGram

MoneyGram is the best app to send or receive money from abroad. It gives you the freedom, speed, and flexibility to move money at your own pace. Because of their shared dedication to innovation, technology, speed, and safety, they have become a proud partner of the Haas F1 Team and helped move the globe ahead.

Avoiding your loved ones a visit to the store, the app makes it simple to send money straight into bank deposits, mobile wallets, or for money pickup in 200+ nations and territories around the world.

Features:

- Send money across borders and also within the US state.

- Pay more than 13,000 registered billers within the app.

- By joining MoneyGram Plus rewards program, you can earn upto 40%.

- Easily set recurring or auto payments on a weekly or monthly basis.

- Know your estimated fees before you initiate your wire transfer.

- Access your profile quickly with the biometric login.

Available on: Android and iOS

Pricing: Free to download

Don’t forget to check this – The iPhone 13 vs iPhone 14: Is It Worth the Upgrade?

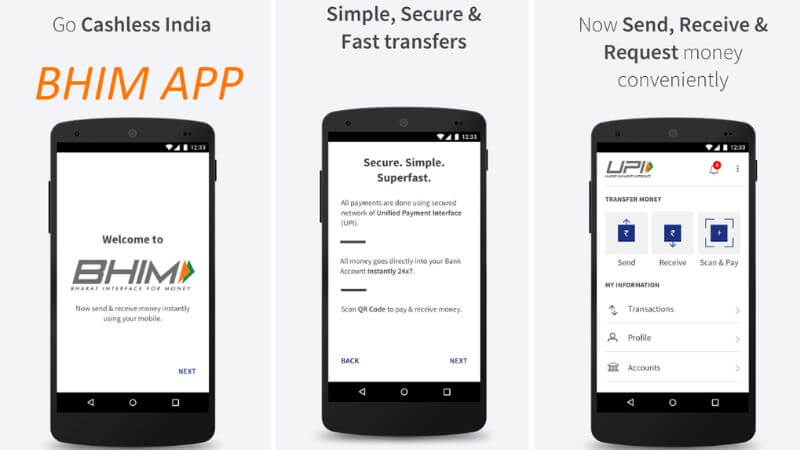

BHIM

BHIM (Bharat Interface for Money) is another one of the safest apps to send money that incorporates UPI to make payments simple, fast, and straightforward. The app was introduced in 2016 and since then has built a loyal customer base across all OS devices.

Users of BHIM can transmit money via VPA, bank account information, or QR code scanning. They can even edit their profiles and view transaction history. The app is simple to set up and offers the next level of secured operations.

Features:

- Send or collect money via VPA, mobile number, account number + IFSC code.

- Transaction limit may vary as per your BHIM’s limit and it can go from 40,000 to max 1 lac per day.

- Autopay and reminder system so that you never miss any important payment.

- Collaborated with several e-commerce stores to let you shop easily around India.

- Supports more than 20 languages. So, no language barrier.

Available on: iOS and Android

Pricing: Free to download.

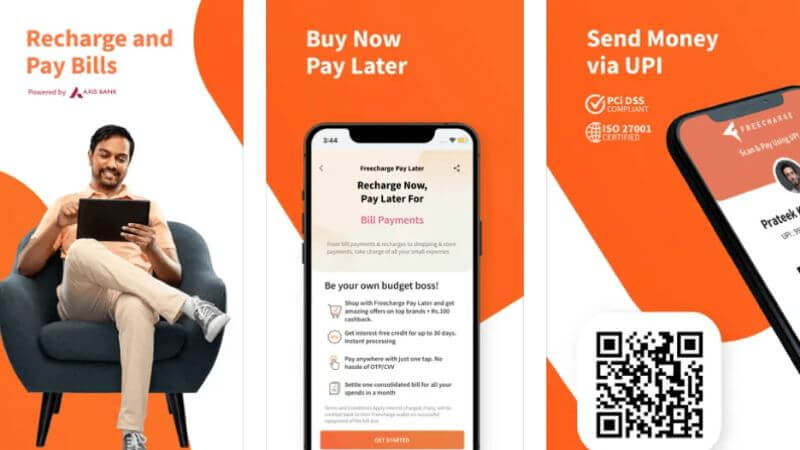

Freecharge

With over 100 million users nationwide and an established name in the market of payment applications, Freecharge has evolved into one of India’s top financial services and investing apps. Freecharge enables you to accomplish anything with ease, from bill paying and recharging to investing and lending.

Features:

- Get your shopping budget with the Pay Later feature. Also, get an instant credit limit of upto 10,000 with a repayment period of a month.

- Invest in top-rated mutual funds with a 100% paperless process.

- Invest in 99.99% pure gold, powered by SafeGold and partnership with Brink and IDBI trustees.

- With Axis Bank’s back support, you can open an FD in as little as 3 minutes.

- Additionally, pay for your utility bills, DTH recharge, mobile and fast tag recharge, loan EMIs, and much more.

Available on: iOS and Android

Pricing: Free to download

Final Words

So that’s all for the best and safest money-transfer apps that you can use for your money-transfer convenience. For many of us, moving money around serves a necessary function, and with everybody having little time to play, efficiency is key. It’s all about ease if you’re using a money transfer app, and we’ve selected these applications based on this principle.

Also, we consider the app’s usability and the platforms it may be used on. We tend to choose money transfer programs that can be used in the app format, even if some providers still allow you to use a personal computer and web configuration. Remember, convenience is the main concern here.

All the aforementioned apps that we listed are highly optimized, offer potential features, and make cashless transactions possible anytime and anywhere.

We hope you found this blog informative!

Do share with us in the comments section below which money-transfer app you like the most. Also, if you are already using one, share your experience with that too.